How do I save?

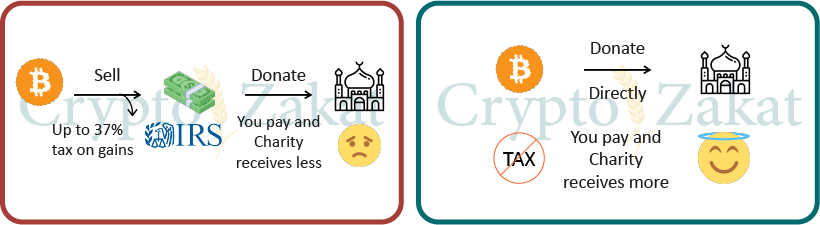

If you were going to sell some of your crypto or stock to donate USD to your favorite charity, you should think twice; directly donating appreciated assets that you have held over a year can enable significant tax savings. Depending on your tax bracket and jurisdiction, selling crypto or stocks held for over a year might subject you to up to:

- 20% Federal Long Term Capital Gains

- 3.8% Medicare surtax (NIIT)

- 13.3% State tax (CA)

Altogether, that is 37.1% of your gains that you would have to forfeit to the taxman. Depending on where you reside, you may even have to pay city tax on top of that! If you itemize deductions on your tax return, directly donating your stock or crypto can circumvent these taxes, allowing your charity to receive significantly more dollars from your donation than if you were to liquidate your assets to donate USD.

Despite these significant potential savingsaccording to a 2016 study by Fidelity Charitable, 80% of donors own appreciated assets, but only 21% of those donors have directly donated these types of assets to charity. The reasons reported are various; “the process is too burdensome”, “the charity I want to donate to doesn’t accept it”, “I don’t want to donate an asset that will continue to appreciate”, etc. Indeed, it is common for crypto enthusiasts with high conviction to be very averse to letting go of their coins!

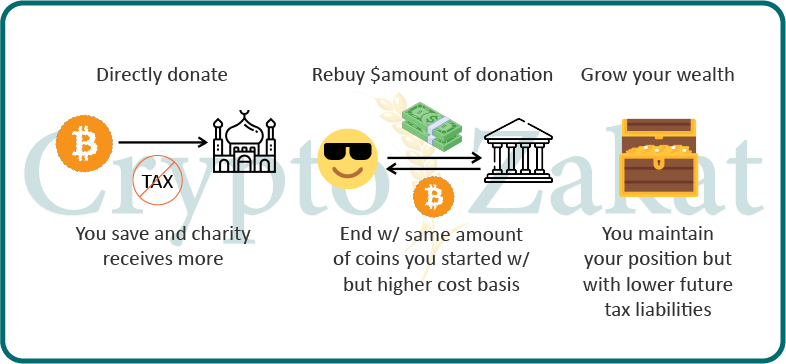

But taking advantage of the tax breaks associated with donating long term capital gains assets doesn’t have to mean reducing your exposure to them. You can maintain the exact same amount of shares or coins by spending the dollar amount you just donated to rebuy the donated asset off an exchange. In all honesty, if you have any appreciated assets at all and you intend to make a donation, you should almost always donate the asset instead of cash.

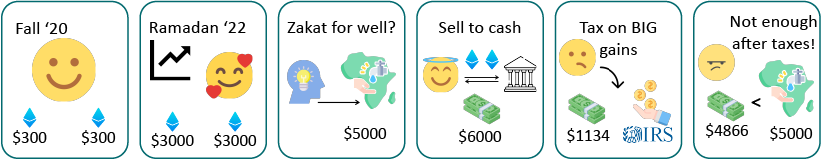

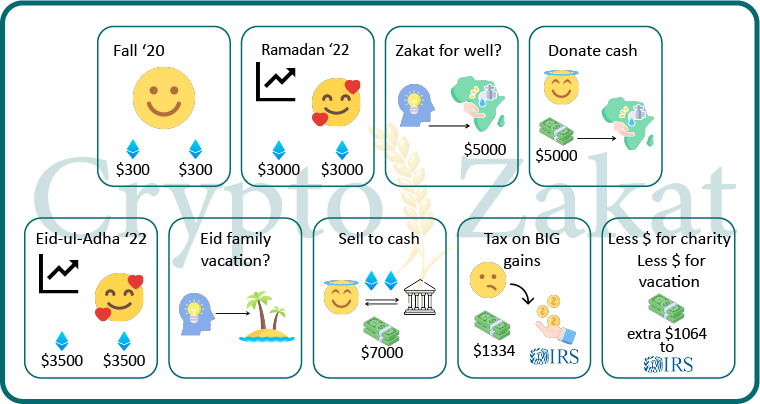

Let’s play out a scenario to better demonstrate. Say you bought 2 Ether in fall of 2020 at a cost basis of $300 each. It’s now Ramadan of 2022, Ethereum is worth $3000 each and you want to donate $5000 to establish a well in Kenya to fulfill your zakat for this year. If you sell your 2 Ether, you’ll net a profit of $5400, which would be enough to cover the donation, but you also just earned a taxable $5400. Unless your annual income is under $41k (including your freshly printed $5400), you’re still on the hook for 15% federal capital gains tax on that $5400. You’re also not in one of the 9 states without additional capital gains tax. Let’s say you’re in California. Even if your income lands you on the softer side of the progressive tax rate, you’re looking at 6% or more if your annual income is over ~$34k. So your combined tax rate on your gain is 21+%, meaning you can expect a tax bill of at least $1,134 on the 2 ETH you sold. So while your total proceeds of selling 2ETH are $6000, you’d actually only have $4,866 and would come up short of your $5000 target to establish the well.

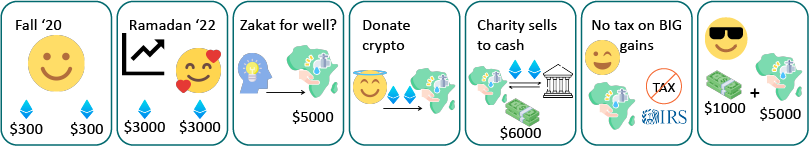

Instead, you directly donate your 2 ETH, your charity now nets $6000 and you have no tax associated with the transaction.

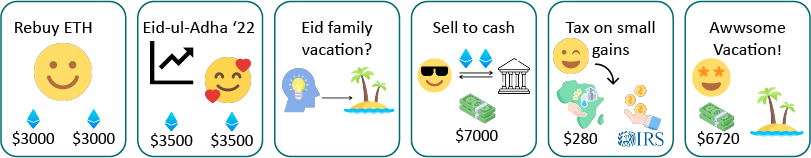

You’re still bullish ETH, so you decide to replenish your Ether stack by buying back 2 ETH at $3000 each. Eid-ul-Adha comes around and you decide you want to sell your ETH to take your family on a nice vacation. ETH pumped a bit over the few months since you bought, and you now sell at $3500 each for $7000 in total proceeds. You’re now dealing with a short term capital gain, which is taxed at the ordinary income rate (22% federal + 6% state for your tax bracket, yielding a combined 28+% tax on your gains). Your combined short term capital gains tax rate is palpably higher than the 21% you paid for long term capital gains, but since you advanced your cost basis to $3000 per ETH by being strategic with your zakat, the taxable amount on your 2 ETH sale is only $1000, yielding an associated tax bill of only $280. You have $6720 leftover for what will unquestionably be an awesomely memorable vacation. Eid Mubarak indeed!

Alternatively, had you instead donated your zakat in cash from your bank account and held your ETH until Eid, you’d still have $7000 in proceeds from selling 2 ETH at $3500 each, but since your cost basis from buying in fall of 2020 was $300, you are looking at a taxable amount of $6400. Even though you are subject to the lower 21% rate since it is a long term capital gain, you end up with an associated tax bill of $1344, which means $1064 less to spend on your vacation. Would you really rather give that $1064 to Uncle Sam?

*Scenarios described on this site are for educational purposes only and do not constitute tax or legal advice. Potential savings will vary from situation to situation. We encourage you to consult a tax professional

Articles For Non-profits

Join our mailing list to stay up to date with new features we are building

DISCLAIMER: CryptoZakat’s tools utilize API data from third party sources that can be prone to market volatility, which may cause divergence from the reported price of an asset while utilizing the tool and the price a donation is executed at. Cryptozakat’s price quotes should not be used when completing official tax documents. The tools and resources on CryptoZakat.io are for educational and informational purposes only and are not intended to constitute, and should not be relied on for, tax, legal or accounting advice. Some donations may require qualified appraisals in order to be granted tax exemption from the IRS. Optimal tax strategies can vary greatly from person to person and we strongly encourage users to seek qualified guidance from a certified professional accountant or registered tax lawyer.

Copyright © 2025 CryptoZakat.io. All rights reserved.